Why Leaders Are Still So Hesitant to Invest in New Business Models

Harvard Business Review

DECEMBER 21, 2016

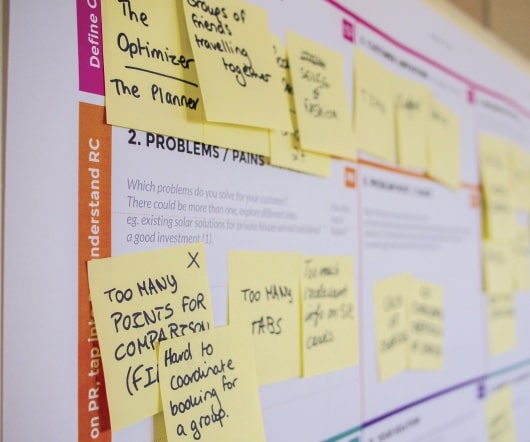

More troubling, our own research shows that even when business leaders are proactive resource allocators, they are still hesitant to invest in new business models. Consider the dramatic shift in the types of assets that create market value. How much is changing? It is easy to understand why this is the case.

Let's personalize your content