Leadership Is About Alignment

Tanveer Naseer

JULY 14, 2015

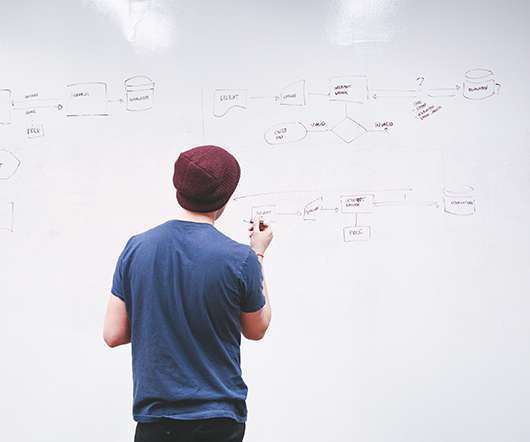

There are as many definitions for leadership as there are companies that have leaders, yet at the core, leadership is about alignment. In fact, leaders leave companies when their personal values clash with the corporate values. When you do something that is against your values, you are out of internal alignment.

Let's personalize your content